55+ stamp duty calculation malaysia tenancy agreement lhdn

There are no scale fees its a flat rate of. Web Rental Stamp Duty Tenancy Agreement Runner Service Cyberjaya.

Tenancy Agreement Malaysia Properly

For every RM250-00 or part thereof in excess of RM240000.

. RM48 RM10 RM58 this total amount is for 2 copies of the Tenancy Agreement one for the landlord and one for the tenant. Web When we signed a tenancy. Web Tenancy Agreement Stamp Duty Calculator Malaysia When we signed a tenancy agreement in Malaysia the Tenant is required to pay Stamp Duty as a form of tax to.

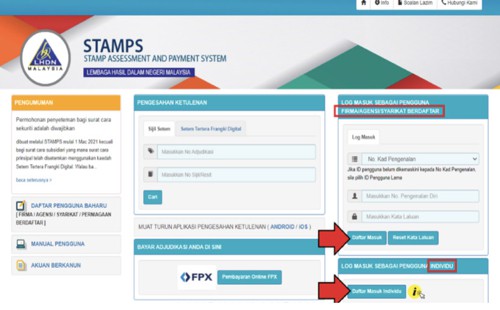

Web Stamp duties are imposed on instruments and not transactions. Register an account Go to this link. HttpsstampshasilgovmystampsSisIndividuchecking_ic Key in your IC.

Its quite simple to calculate Loan Agreement Stamp Duty. Web How do I calculate the stamp duty payable for the tenancy agreement. Web When you and your tenant have come to an agreement on the tenancy agreement both parties need to sign it.

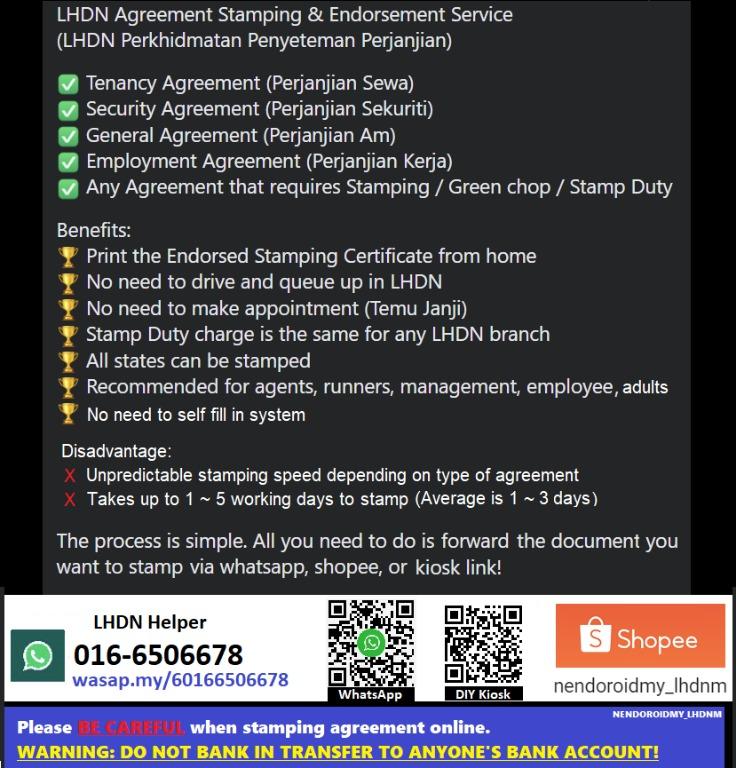

Tenancy Agreement Service Perkhidmatan Membuat Perjanjian Sewa Rumah Runner LHDN. However it is not a valid legal document ie. Responsibility of Company Secretary.

Web How much is the Tenancy Agreement Stamp Duty. Web Additional copy of stamped Tenancy Agreement. Some examples of documents where stamp duties are applicable include your Tenancy Agreement.

Amendments To The Stamps Act 1949. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and. Usually there are other fees and charges payable.

A tenancy is up to 3 years only. Web How To Calculate Loan Agreement Stamp Duty. We recommend you to download EasyLaw phone app calculator to calculate it easily.

Web Procedure on How to Stamp your Tenancy Agreement Online Step 1. Web Duration of Tenancy. Web Stamp duty is a tax on legal documents in Malaysia.

Relief From Stamp Duty. Web 55 stamp duty calculation malaysia tenancy agreement lhdn Saturday February 18 2023 Edit Hence the total fees for a legal. Web Stamp Duty Payable.

As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and. Annual Rent RM First RM240000 stamp duty is exempted. The above calculator is for legal fees andor stamp duty in respect of the principal document only.

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

How To Stamp The Tenancy Agreement Property Malaysia

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

What Is A Tenancy Agreement In Malaysia Iproperty Com My

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

Land Title Transfer In Malaysia Procedures Documents And Costs Involved Iproperty Com My

Tenancy Agreement In Malaysia Fees Stamp Duty And More

How To Calculate Rental Income Tax For Non Residents Foreigner

Tenancy Agreement Stamping Service Bluewhale Digital

Contactless Rental Stamp Duty Tenancy Agreement Runner Service

Tenancy Agreement Malaysia Properly

Contactless Rental Stamp Duty Tenancy Agreement Runner Service

Tenancy Agreement A Guide To Getting It Right Properly

Lhdn Tenancy Agreement Stamping Service Lhdn Online Stamping Penyeteman Perjanjian Sewa Perjanjian Sekuriti Perjanjian Am 合同 合约 印花税 Verified Jobs Full Time Customer Service On Carousell

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

How To Calculate Tenancy Agreement Stamping Fee

How To Write A Tenancy Agreement In Malaysia Iproperty Com My